Grain and Cattle Trends

Presented by Heartland Investor Capital Management Inc. CTA

We apologize, but due to a recording issue with our charting software, today’s video is missing the chart drawings normally shown during the analysis.

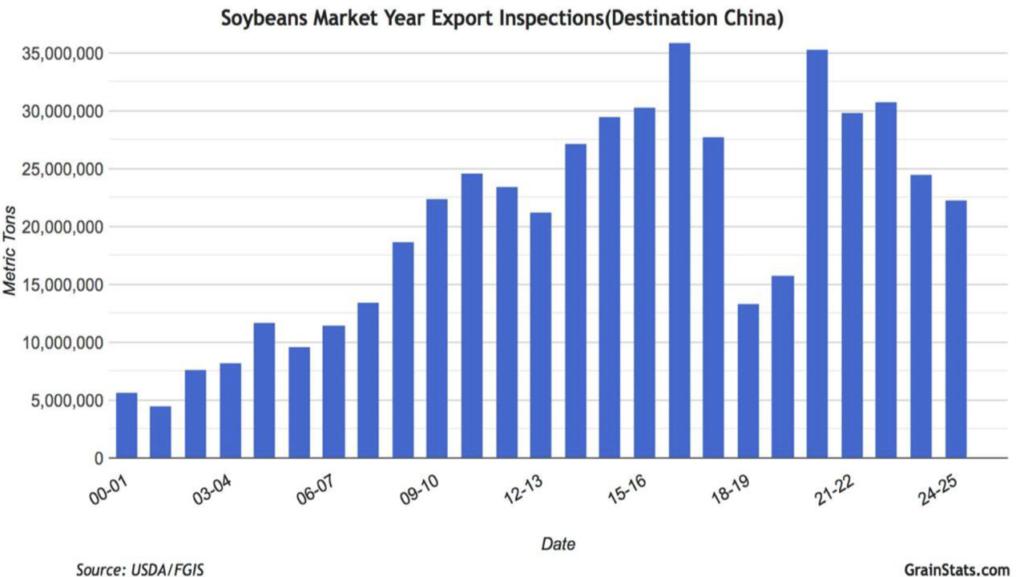

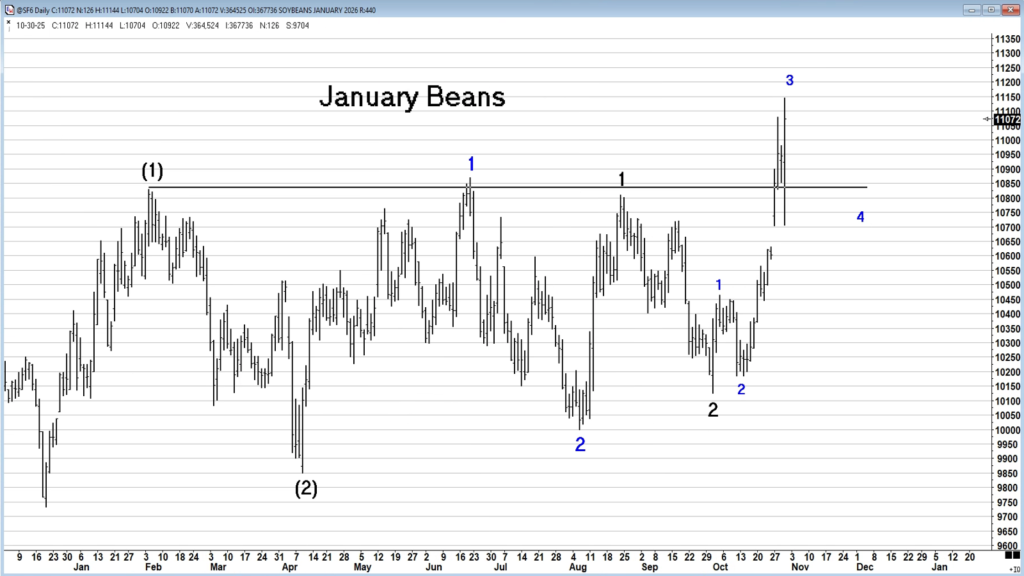

Soybeans:

China to buy up to 12 MMT by year-end and 25 MMT annually for three years

Market eyes potential $12 beans if yields dip below 53 bushels

Wave pattern suggests possible wave five higher; support near 1170 with upside toward 1190–1200

Corn:

Possible wave three high at 437 with support at 424–427

Outside day down avoided; short-term momentum intact

Harvest pressure may test support but structure remains bullish above 424

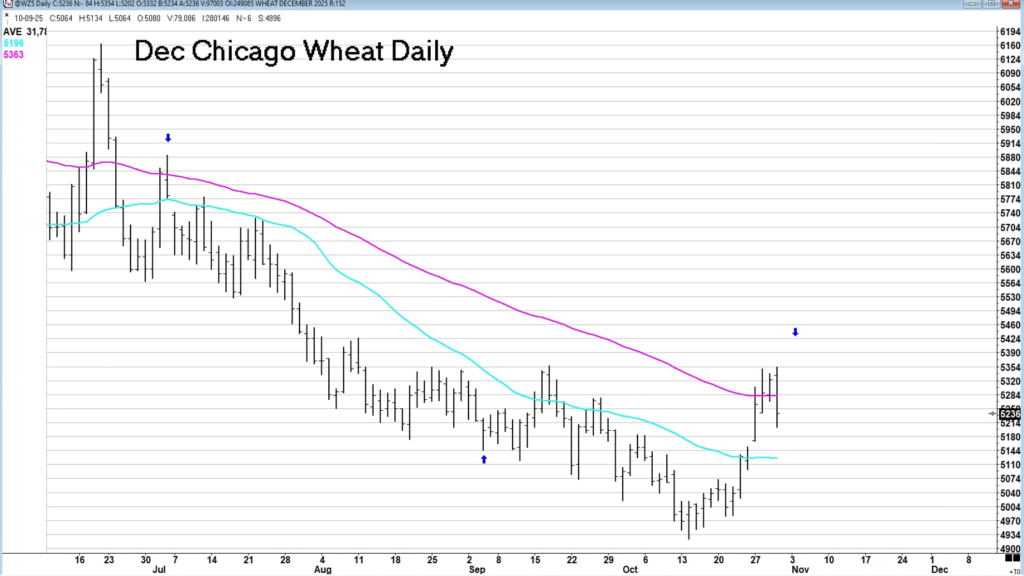

Wheat:

Nearly formed an outside day down but held key levels

Potential 60-day cycle turning point around Nov 3–4

V-bottom pattern suggests seasonal low is in place

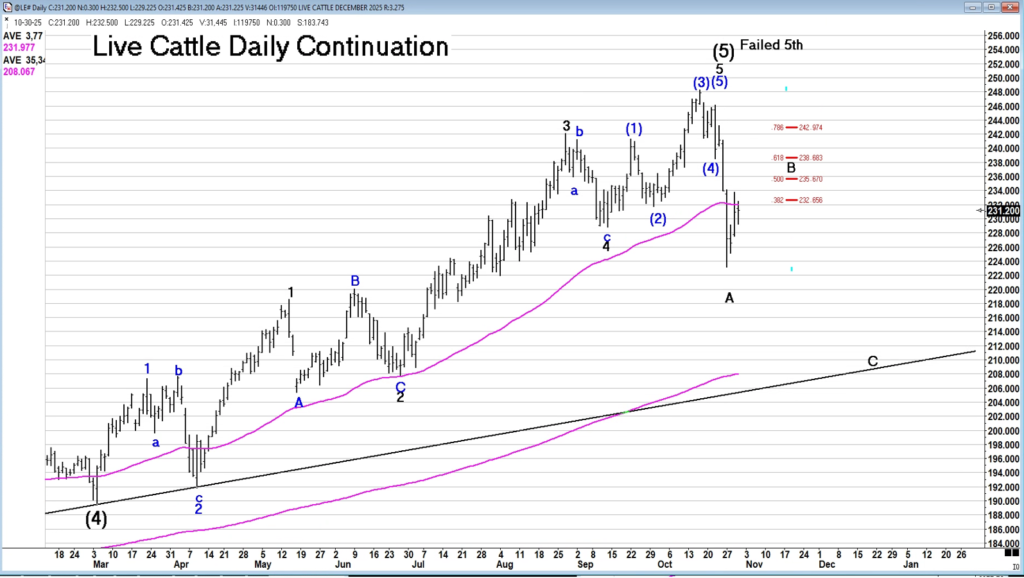

Cattle:

Recovered strongly; resistance at 38% retracement near 232–233

Cash trade soft at 230 vs. 238 earlier in week

Major low at 223 could mark a sustainable base

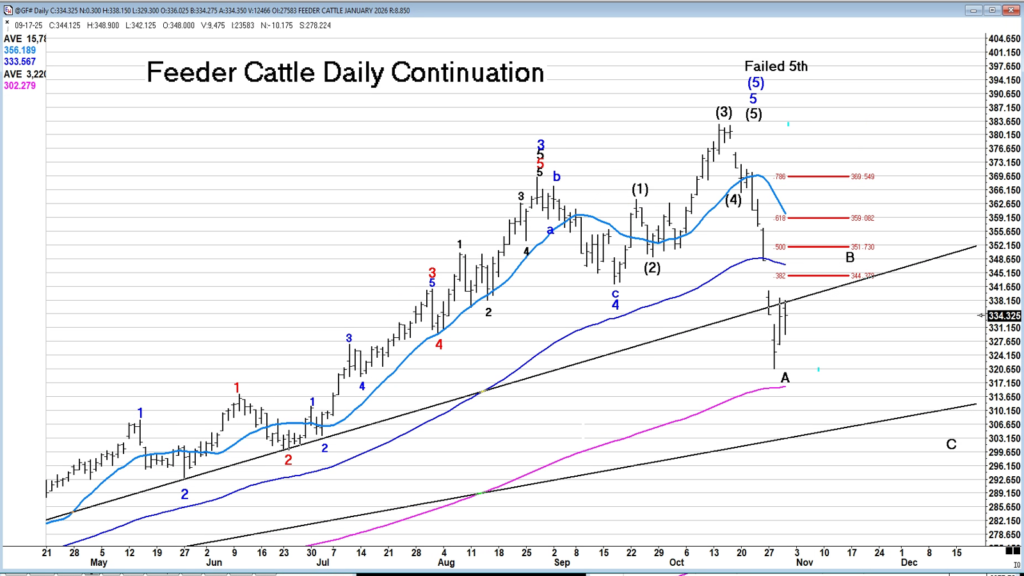

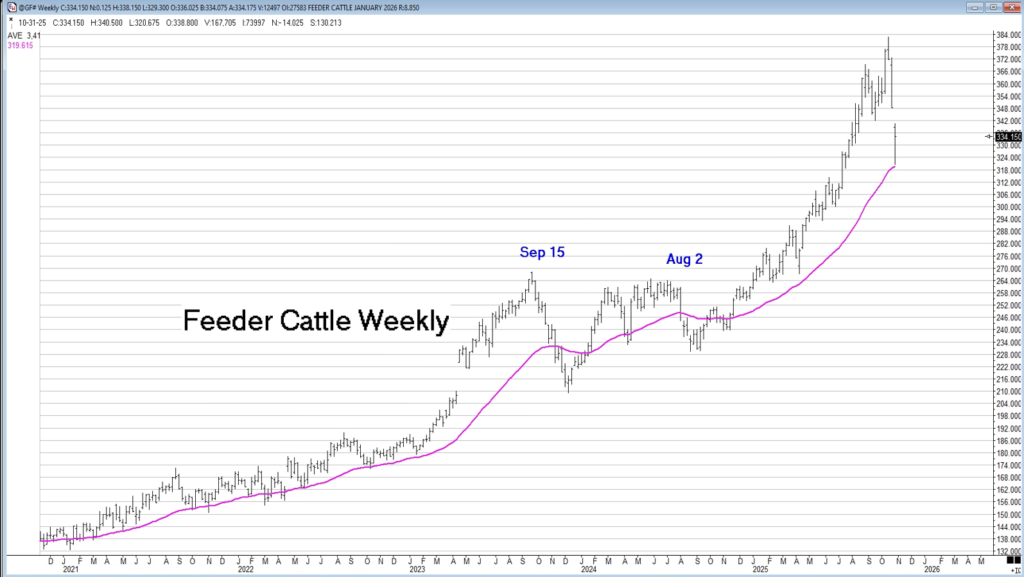

Feeder Cattle:

Failed to reach 38% retracement like live cattle

Potential rally targets 345–350 range (50% retracement)

Weekly chart gap between 342–348 seen as key resistance zone

Other Factors:

Rumors continue on Brazilian beef tariff reductions and limited Mexican feeder inflows

Argentine beef reportedly entering U.S. market

Overall sentiment cautiously bullish across grains; livestock stabilizing after steep declines

Provided by:

Eugene Graner,

Heartland Investor Capitol Management, Inc., CTA

(A separate entity from Heartland Investor Services)

Past performance is not indicative of future results. The information contained in this report is intended for informational purposes only and is the opinion of the writer and may change at any time. This information was compiled from sources believed to be reliable to Heartland Investor Capital Management, Inc. but accuracy cannot be and is not guaranteed. There is no warranty, expressed or implied, in regards to this information for any particular purpose. There is SIGNIFICANT RISK of LOSS involved in trading futures and / or options on futures and may not be suitable for all investors. Investors should consider these RISKS and evaluate their suitability based on their financial conditions. No one should ever consider trading futures or options on futures with anything other than RISK CAPITAL. NO LIABILITY on the part of the author exists for any trading loss you may incur in the use of this information. The information contained in this newsletter is privileged, confidential and protected from disclosure. Any further disclosure or use, distribution, dissemination or copying of this message or any attachment is strictly prohibited. Provided by Heartland Investor Capital Management, Inc. a registered CTA with the NFA, of which Eugene Graner is principal. This entity is a separate legal entity from the Introducing Broker Heartland Investor Services.